Property Tax Arrears Creep Up To Almost Same As Pre-COVID Measures Level

By Robert Thomas

After taking a temporary plunge - due largely to a program to assist property owners become current and establish tax payment plans as a COVID 19 measure - the ugly head of increasing tax arrears has once again stuck its neck out.

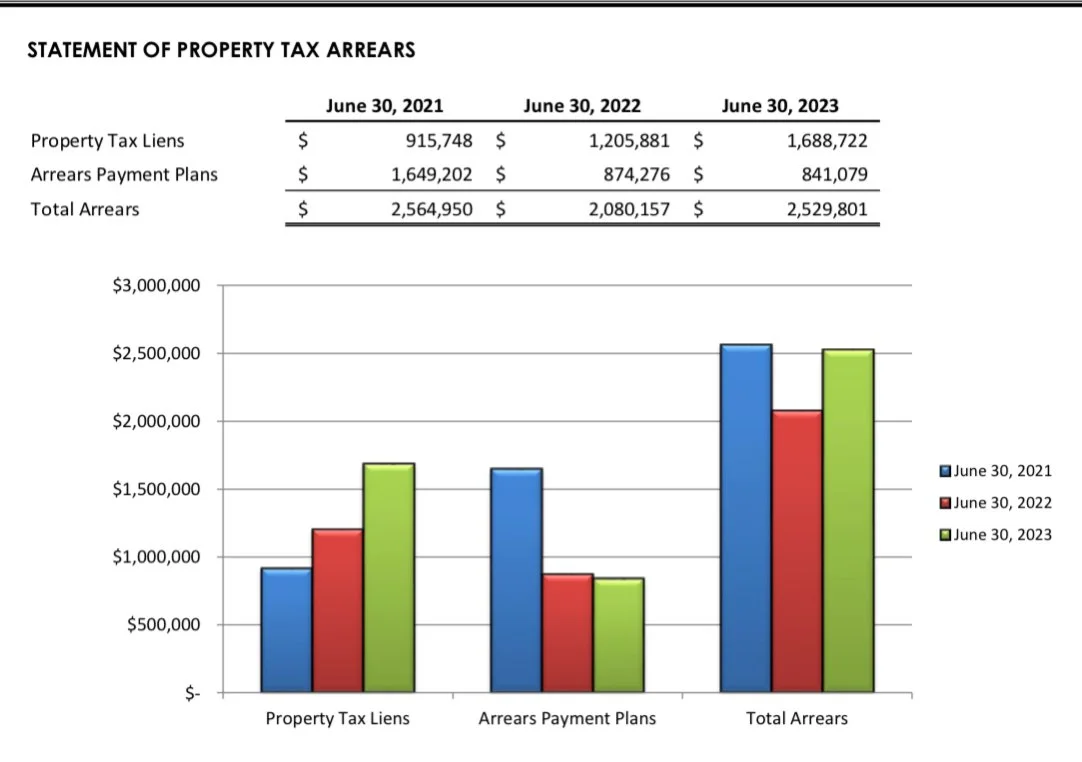

As part of the 2023’s second quarter financial report presented at Monday’s regular meeting of Council tax arrears as of June 30, 2023 were $2,529,801 an increase of $449,604 from the same date a year earlier.

On June 30, 2022 property tax arrears were $2,080,157 which was a decrease of $484,794 from the record high property tax arrears of $2,564,950 on June 30, 2021.

Property Tax Arrears 2021 - 2023 SOURCE City of Moose Jaw

Subtracting the year over year increase in property tax arrears on June 30, 2023 from the year over year decrease on June 30, 2022 shows there is $35,145 less property taxes in arrears a year following the effects of the special COVID -19 measures kicked in.

The improvement in the amount of property tax arrears owing before and then after the special COVID - 19 measures was 1.4 percent.

With the majority of outstanding property tax arrears incurred by commercial properties the level of arrears has been used to judge the state of the local (small business) economy.

Finance director Brian Acker told Council the creep up in tax arrears could be credited to the inflationary economic times as well as the new computerized tax system.

“There is probably a number of things driving that. One of the things is the economic circumstances we are in terms of people being afford to pay their taxes,” Acker said, adding “ the other one is during the implementation of our new tax system we did not do as much tax enforcement as we usually do.”

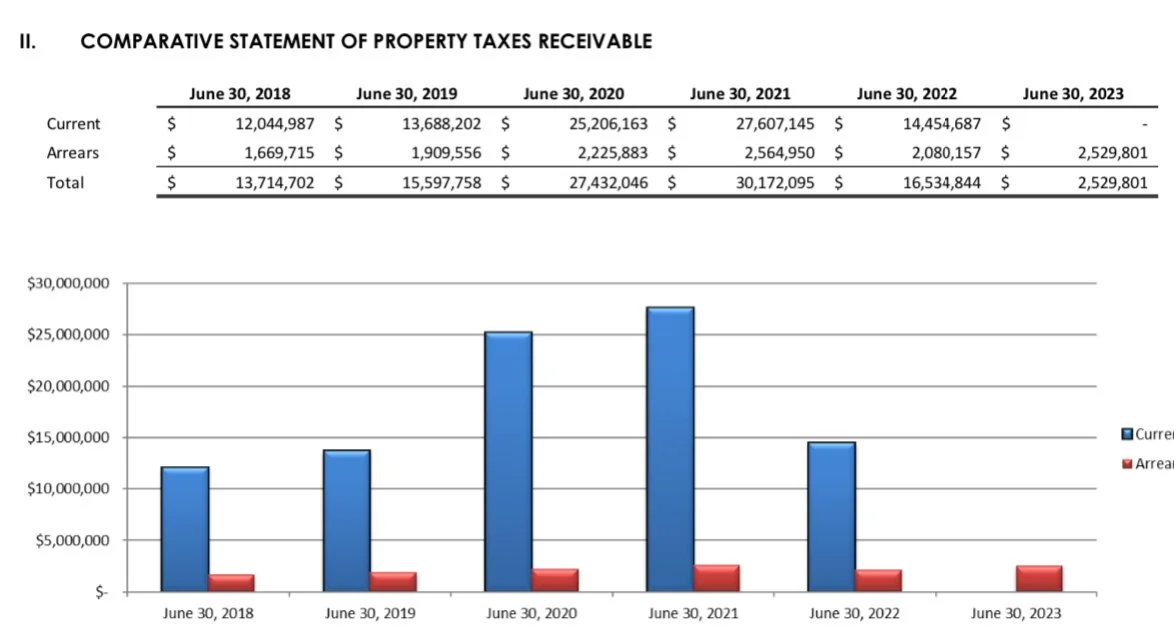

A look at total property taxes owed and in arrears 2018 - 2023 SOURCE - City of Moose Jaw

The graph that shows outstanding property taxes - but not yet in arrears - this year does not include an amount owing on June 30, 2023.

The reason for the amount owing on June 30th is important because it is the usual due date for payment of property taxes without penalties.

This year, 2023, property owners were given an unforeseen break in paying their taxes without penalty until August 31st. The reason for this year’s unexpected extension to pay property taxes without penalty is due to major computer problems experienced by the city impacting the preparation of tax notices.

Administration did not provide how much money in interest payments on unpaid 2023 property taxes were forgone due to the computer problems extending the due date from June 30th to August 31st.