Where's The Beef??? Inflation And Costs

“Any evidence we’ve seen is to the contrary. It’s pretty clear who is doing well, and that is the packers,” Michelle Wasylyshen, spokesperson for the Retail Council of Canada speaking to the Toronto Star.

By Robert Thomas

Part Three In A Series

For those who are unaware of what it is inflation is the increased price for goods and services.

Although price increases are seen as bad a certain amount of inflation is good for the economy.

Prices and wages go up all of the time the problem is when inflation reaches a certain point it becomes excessive meaning consumers cannot afford the item and no longer buy it or they forego other items to purchase an item that has gone up in price.

The Consumer Price Index (CPI)

The Consumer Price Index or CPI is a major economic indicator and it is widely referenced when it comes to inflation and the ability of consumers to purchase the goods and services they need to survive.

The CPI is often described as a weighted basket of goods the average consumer needs to purchase.

The CPI is weighted because the same rise in the price of certain items do not effect consumers as much as a price increase for other goods and services.

For example a 20 percent price increase in the price of milk has less of an impact on the CPI than does a similar 20 percent increase in the price of fuel.

Although milk may be good for you the amount of milk an individual consumes and its importance is less than buying fuel. Fuel such as gasoline is used more by consumers than milk so gasoline is weighted higher.

If you take a look at the CPI (in the chart below) food is weighted at just over 15 percent. While housing is the largest component of the CPI at the 30 percent mark. While clothing is between three and five percent over the three year period.

So the big three most people see as the essentials to life - food shelter and clothing - are given a weight of 50 percent in the CPI.

As discussed earlier, transportation or fuel, has the same weight in the CPI as food.

What makes up the CPI or the basket of goods and the weight each item is given is determined by economists working for the federal government.

The weight of each item in the basket which makes up the CPI is derived from consumer habits in the Household Final Consumption Expenditure (HFCE). The HFCE data is combined with data obtained from third parties to see an overall consumer preference for variety of goods and then weights them before putting them into the CPI.

Overtime the increase in prices in the CPI basket is used by Statistics Canada to show what the inflation rate is.

Recent Developments

Recently the CPI or the inflation it measures has been impacted in two areas - fuel and food.

In the most recent CPI released by Statistics Canada the CPI in June 2022 compared to June 2021 saw an increase of 8.1 percent. If you removed the price of gasoline from the CPI the year over year increase is 6.5 percent which is higher than the 6.3 percent increase in May 2022 versus May 2021.

During June the CPI saw a decrease in the price of homes which had the effect of moderating the weighted CPI.

But despite this the CPI rose more than what economists and the Bank of Canada would like to see - a two percent target increase since 1995.

To lower inflation you can do one of two things.

Flood the market with more goods than consumers can buy (in practicality an impossibility) and allow supply to do it. Or you can reduce demand. You reduce demand by taking the means to buy goods - money - out of the system.

To reduce the money supply the Bank Of Canada sets its key lending rate - the rate it charges banks to borrow money - which results in the banks increasing their lending rates. As consumers are charged more to borrow they reassess purchases and on big ticket items - such as homes - the demand goes down and prices drop.

If you look at the CPI data while there was an increase in the CPI of 8.1 percent from June 2022 to June 2021 at the same time wages rose only 5.2 percent based upon the latest Labour Force Survey.

Consumers are on average seeing their buying power eroded.

How Does This Effect Consumers Buying Beef??

If you take a look at the price of food year over year the major increase has been in butter, edible oils and meat (most notably beef).

In Saskatchewan (see chart below) meat prices went up 11.3 percent from April 2021 to April 2022 while retail beef prices went up 17 percent in the same time period.

From March to April 2022 the retail price of beef increased 6 percent in the one month period.

Year over year food price increases April 2022 versus April 2021 and March 2022 versus April 2022 - source Statistics Canada

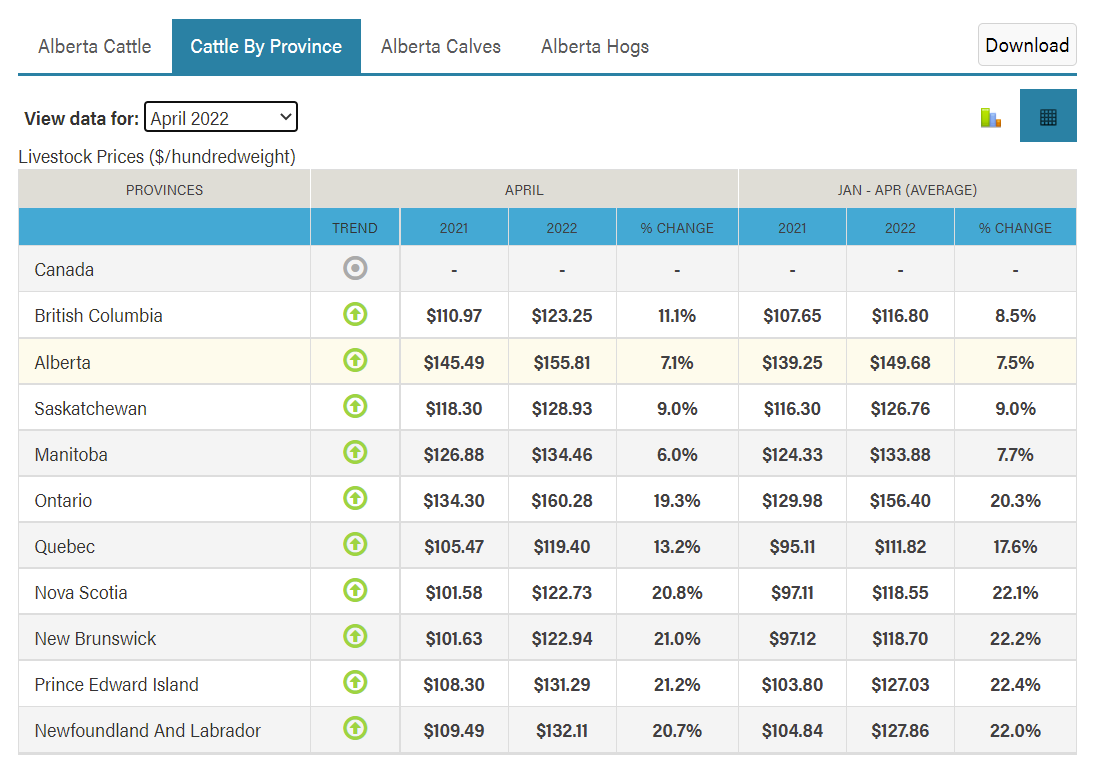

While over the same April 2021 to April 2022 year to year increase for live cattle increased by nine percent (see chart below).

Seemingly the cattle prices are going up to match the demand and store prices.

The problem for rancher/farmers and feedlot owners are the fixed inputs - feed and labour - they need to produce a pound of beef.

The latest market information provided by the Saskatchewan Department of Agriculture show the United States Department of Agriculture prices for cattle as stable year over year.

But the cost of Lethbridge barley - used to feed cattle in feedlots - has risen over 30 percent year over year.

The problem if there are profits at the retail level who is earning them?

In a July 7th Toronto Star article Michelle Wasylyshen, spokesperson for the Retail Council of Canada, which represents major grocery chains including Loblaw, Sobeys and Metro said retailers were not making windfall profits.

“Any evidence we’ve seen is to the contrary. It’s pretty clear who is doing well, and that is the packers,” Wasylyshen told the Toronto Star.

MJ Independent was unable to contact JBS Canada for comment on this series of stories.

MJ Independent was however able to get ahold of Cargill who referred us to the Canadian Meat Council who represents meat packers and processors, large and small.

After speaking to the media representative at the Canadian Meat Council, where we sought comment to hear their side of the story for a more rounded series of stories, their media rep said they were unable to answer the questions but someone who was away on holiday may be able to.

After one week we received no further answer from the Canadian Meat Council.